10 Important KPIs to Measure the Financial Health of Your Business

How will you know if your business is performing well? We list essential finance and accounting KPIs to help your business achieve its goals.

Working capital management determines if your business is profitable and sustainable. Learn how to compute and maintain a stable working capital value.

When you look at the Balance Sheet, you can have a glimpse of the financial health of your business. By looking at its assets and liabilities, you can assess its sustainability. As a business owner, you have to ask yourself if your assets can cover your financial obligations while driving earnings and growth to your business.

Your current assets and liabilities can assess operational efficiency and liquidity. They form part of your working capital as they affect the core operations. That is why working capital management is integral to sound cash flow management. This article will discuss working capital management and its fundamental components.

Working capital is the net value of your cash, inventories, receivables, and payables. Also called net working capital (NWC), it focuses on current assets and liabilities. Simply put, it is the difference between the current assets and liabilities. To avoid confusion, remember that its formula differs from the current ratio.

Working Capital = Current Assets – Current Liabilities

Current Ratio = Current Assets / Current Liabilities

With that, this account gauges your business liquidity and operational efficiency. It shows short-term financial position to determine if it can cover short-term obligations. In general, a positive working capital indicates the potential to invest and grow. Meanwhile, a negative NWC means current liabilities exceed current assets. You may have a hard time paying your suppliers and creditors.

These values, however, are never just black or white. If the value of your NWC is too high, check your assets. More often than not, too much inventory and low inventory turnover cause it. It can also be because you have excess cash but do not invest it. The value of your NWC can be negative if you have a large cash outlay. This scenario often results from a large purchase of products and PPE. A rule of thumb is that your NWC is negative when the value of your current ratio is less than one.

Don’t worry if you’re struggling with wealth capital management. Check out Spenmo today to learn more about how you can manage your payables.

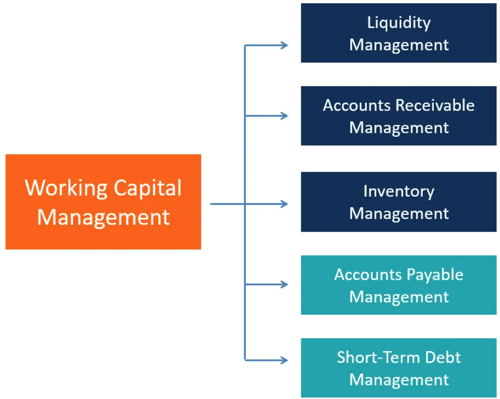

Many manufacturing companies employ working capital management to ensure liquidity and operational efficiency. It focuses on working capital – current assets and liabilities. This method is crucial for improving receivable collection and inventory management.

Its primary purpose is to ensure adequate cash inflows to cover current obligations. If you go to the Cash Flow Statement, you will see this part in the Operating Activities. As mentioned, it deals with current assets and liabilities. To understand it better, we have to know what comprises working capital.

Current assets involve all liquid assets. In short, these are assets that are cash convertible in less than a year. Some common examples are accounts receivables, inventories, and short-term investments. But, other analysts remove inventories in the computation. At times, you can hardly convert them into cash, especially raw materials and goods in process.

Meanwhile, current liabilities refer to obligations due in twelve months. These include accounts payable, accrued expenses, short-term borrowings, and notes payable. It also consists of the current portion of long-term borrowings. As such, working capital refers to your resources and obligations within the year.

Working capital management monitors cash flows from changes in current assets and liabilities.

The goal is to achieve the correct level or value of working capital by using ratio analysis of key components of working capital. Typical examples are the working capital ratio and inventory turnover ratio.

Proper account payable management is essential in maintaining a good working capital. Utilising credit arrangements, cash payments, and scheduled supplier payments are just some of the ways you can do to maintain proper cash flow.

Image Source: Corporate Finance Institute

The first step is to assess your working capital. You can do workflow capital management in different ways, but the best way to begin is to determine your working capital first. You can do it with the help of working capital formula. Here are some key financial ratios you can use for this.

Working Capital Ratio, also known as the current ratio, measures the liquidity of the company and its capacity to cover its short-term obligations. It is calculated by dividing current assets by current liabilities.

While it is important to have a ratio above one, values vary with industry. A ratio below 1 indicates that you may have to sell off some assets and secure long-term borrowings. Also, you may resort to other financing options, such as equity financing.

In general, ratios between 1.20 and 2.00 are desirable. But if the value exceeds 2.0, you may have to check your assets. If the inventory is too high, it can mean that you are not efficiently utilising it to generate revenues. Concerning cash, you may have to invest it for further growth or consider an expansion.

Other financial analysts do not rely on this ratio alone. They disregard inventories in the computation of Quick Ratio or Acid-Test Ratio. As such, they focus on more liquid assets or those you can convert into cash faster. Here is how to compute them.

Working Capital Ratio or Current Ratio = Current Assets / Current Liabilities

Quick Ratio or Acid-Test Ratio = (Current Assets – Inventories) / Current Liabilities

Inventory is essential for your business. After all, what is there to produce and sell if you don’t have any of it? With that, you must maintain sufficient inventory levels to maximise efficiency. In that way, you can meet customer demand while avoiding overproduction.

To measure efficiency, you can check the inventory turnover ratio. You can calculate it by dividing the Cost of Goods Sold (COGS) by the average inventory reported – which shows how fast stocks are sold and replaced. As such, a low ratio may show overstocking. You may have to lessen inventories or think of strategies to sell them. Meanwhile, a very high ratio may imply underproduction. You may have to produce more to meet the demand.

Inventory Turnover Ratio = COGS / Average Inventory

Average Inventory = (Inventory Current Period + Inventory Prior Period) / 2

The collection ratio, also known as Days Sales Outstanding, assesses how you manage your accounts receivables (AR). It determines the average number of days to collect payments after the transaction. You can compute it by dividing the product of average AR and accounting days by sales per day. With that, the lower the ratio, the faster you collect receivables and turn them into cash. If it is high, you may have to be more assertive to collect more receivables. Doing so will help you prevent or at least reduce bad debt provisions.

Collection Ratio = (Average Accounts Receivables x Accounting Days) / Average Daily Sales

Overall, the management of working capital helps you assess liquidity. But with the ratios you can use, you realise there is more than meets the eye. You’ll have to manage and utilise cash, receivables, and inventory. Here are some reasons why working capital management is vital to your business.

With working capital management, you can do a better job of tracking receivables. You must determine how much receivables to collect to sustain your operations. How much bad debt can your business tolerate? Credit terms, in general, last from 30 to 90 days. In turn, you will be more cautious when extending credit to your customers.

Working capital management through inventories ensures that you optimise your resources. It aims to keep inventory at a manageable level to keep with market demand. More so, it prevents overproduction or overstocking. With that in mind, you can stimulate revenues and manage costs. Your operations will become more profitable.

Accounts payable often come from credit agreements with your suppliers. With proper management, you can maintain the balance between procurement and payment. Early payments may be unnecessary and cause an unfavorable impact on your liquidity. Meanwhile, late payments may affect your reputation and relationships with suppliers.

Meanwhile, short-term borrowings come from banks and other lending institutions. In contrast to accounts payable, short-term borrowings bear interest. You may opt to have a revolving credit agreement to help you deal with unexpected expenses. But, you have to be more careful to avoid higher interest rates and mar your creditworthiness.

Working capital is a vital metric of the fundamental health of your business. It represents the resources you have to make transactions and meet unexpected costs. It also helps you ensure that your business runs smoothly. But, managing working capital can be challenging at times. Hence, you have to consider these objectives.

One of the goals of working capital management is to optimise the capacity of your resources. One way is to help you reduce the costs of inputs while maximising ROI. For instance, how much inventory do you need to meet demand and generate revenues? More so, it decreases the need for financial leverage.

Another goal is to ensure that you have enough cash to cover short-term obligations. One way is to ensure consistent receivable collection and reduce bad debts.

Once you optimise resources and ensure liquidity, you will have more room for growth. You can enjoy economies of scale through efficiency. More so, you can invest and expand to scale up production.

As mentioned, the working capital definition may vary from one industry to another. You have to remember that there is no one-size-fits-all method for it. Only when your business starts will you find the most appropriate approach. Here are some factors that may affect your working capital needs.

You have to consider the nature of your business and to which industry it belongs. Also, you have to know what kind of product or service you offer. In that way, you can see the internal and external factors. For example, you are in the food industry. You have to know what type and amount of materials you need to produce it. You can also assess market demand and the level of competition. With that, you can scale up production and generate revenues.

From raw materials and supplies, you have to assess your capital and labour. Can your company sustain the level of output you desire? Check if your means can cover your obligations. You can determine how much to cover and borrow if you want to expand.

| How to Effectively Manage Working Capital | |

| Maintain Timely Payments | It does not always mean that you have to pay in advance for discounts and perks. But, timely payments can save you from higher expenses and reputational damage. You can establish good relationships with suppliers and lenders and increase your creditworthiness. |

| Improve Receivable Collection | This will help in converting receivables into cash. It will help you avoid bad debt provisions. |

| Manage Inventories | Managing inventory procurement will help you improve inventory turnover. You can prevent overstocking and meet market demand for higher revenue. |

Working capital management can be challenging and time-consuming. But with proper solutions and strategies, you can be more efficient with your time and cut down the work. Spenmo is the all-in-one payables system that allows you to manage your payments in a single dashboard.

Moreover, Spenmo extends its support by offering credit to businesses, which they can use for their payments in their Spenmo wallet.

Talk to our team about how you can open a Spenmo account today!

Yes and no. Paid salaries are not considered as part of borrowings or payables. Hence, these do not form part of current liabilities and affect working capital.

Meanwhile, unpaid salaries accrue and become part of accounts payable. As such, you must add these to the computation.

Working capital management optimises tools like working capital financing policy, EOQ, and JIT. Some include cash budgeting and working capital financing policy.

Some common solutions businesses use are electronic invoicing and corporate cards.

How will you know if your business is performing well? We list essential finance and accounting KPIs to help your business achieve its goals.

What are liquid assets? Discover how they're defined, and how they differ from illiquid assets. Visit now to learn more.

Learn what accrued expenses are, and how they work. Discover ways to make your accounting simpler and easier. Visit us now.

Sign up to get the latest news, updates, and special offers delivered directly to your mailbox