Remote Working Trends in Singapore

As Singapore emerges from the virus strong, what strategies will business owners take to implement an efficient remote working scheme?

Singapore is attractive to business owners. If you own a business, learn the top reasons why you should incorporate it in Singapore.

From there, you must check the external factors, such as demand and level of competition. Laws and economic conditions directly influence your business operations as well. This information can help you determine the ideal market to launch your business.

Emerging economies in Southeast Asia show promise in growth and investments. For this reason, company registrations and foreign direct investments (FDIs) have grown since the 1990s. This holds true in Singapore due to its thriving economy and reliable government policies that support startups. With that in mind, we will take a closer look at the advantages of incorporating in Singapore.

Singapore is one of the smallest countries globally. But, it has always been ahead of its time. As such, it is no surprise that business formations and capital inflows are high in the country. These aspects make Singapore attractive to businesses, investors, and immigrants. Here are some reasons to incorporate in Singapore.

Over the past decades, Singapore has proven its durability. A stable economy and business environment are what make it attractive to entrepreneurs. Many times, it has averted the severe effects of several global crises. Amidst the pandemic, it has regained its footing fast and bounced back higher.

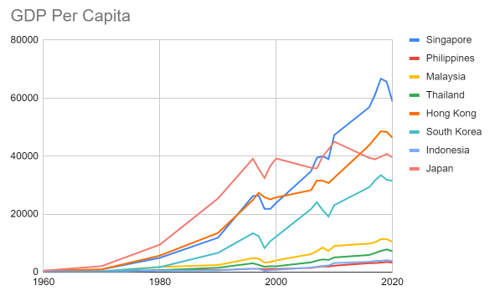

Since its independence from Britain and Malaysia, Singapore has shown robust growth. Thanks to its prudent policies that focused on trade and economic development. With that, it emerged as one of the Four Asian Tigers or Asian Miracle. Along with Hong Kong, Taiwan, and South Korea, Singapore minimized wealth disparity.

Singapore has gone through rapid industrialization since the 1960s. Aside from its export-centred policies, it has invested in education and infrastructure. From 1960 to 1980, GDP per capita grew by over 1,000% from $428 to $4,928. It had an average annual GDP growth of 7.5% for the succeeding decades.

It has gone through several financial crises. But, it proved to be resilient and stable. During the Asian financial crisis, it remained unscathed. When the Global Financial Crisis hit, it suffered for a short period. But, it had a strong rebound, surpassing the 2006-2007 values in only a year.

Taken from World Bank

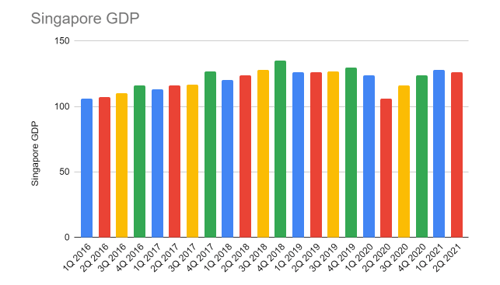

In 2020, Singapore’s GDP fell by 5.4%, yet figures in 2021 show a more optimistic outlook that exceeds pre-pandemic levels. We saw an average of 7% in year-on-year GDP growth in all quarters of 2021. With its prudent policies and faster vaccination, its recovery has been swift. The inflation rate remained at a manageable level.

At the end of 2021, GDP may range from $360 to $370 million. Meanwhile, the inflation rate may stay within 1.5-2.5%. Things may get even better in 2022 as it continues to ease its restrictions and reopens its borders. Given this information, it is wise to say that Singapore has maintained its robust growth. Its economic advantages are the primary factors for its resilience and strong rebound.

Taken from Department of Statistics

Taken from Department of Statistics

Many people know that Japan’s economic strategy inspired Singapore and Hong Kong. In the 1960s and 1970s, these two Asian Tigers invested heavily in education. It has paid off shortly as the labour market improved with highly skilled workers. The grades that the students receive can match the global comparative standards.

Despite their educational background, Singaporeans do not become too complacent. Instead, they remain hardworking and compliant. Moreso, Singapore implements liberal immigration policies that employ skilled immigrants. With an employment pass, foreigners can apply for a work visa. It is no wonder that about 30% of the labour force comes from other countries.

Tax complexity is one of the biggest deterrents to tax filings. The bracketing can determine whether tax levied per income is reasonable or not. Singapore has one of the most rational and straightforward tax systems in Asia. Capital gains and dividend income are not taxable. Investors do not need to do a complex computation for dividend tax credits. Both businesses and investors can always prevent double taxation.

The Singapore government provides a conducive tax climate for a new company. It uses a tiered system for personal and corporate taxes. Moreso, startups enjoy tax breaks in the first three years from their incorporation. As such, their corporate tax rate is capped at 17% and can be as low as 0% for the first $100,000 income. Only 20% of income above $320,000 is subject to taxes for personal taxes. Singapore levies one of the lowest VAT rates globally.

The geographical location is a top contributor to its impressive trade performance. Singapore is just a plane away from many other city-states in Asia. It is open to the 3-billion population of the continent. Its port is so active that it became a central International Maritime Center. Meanwhile, Changi Airport is a world-class airport in Southeast Asia. It can cater to about 20 million passengers every year. It provides direct flights to the most popular and developed cities globally.

The ease of doing business in Singapore entices more companies and investors. In fact, it ranked second on the World Bank’s Ease of Doing Business survey in 2020. Some reasons for this are its bureaucracy-free regulatory frameworks and efficient processing. It only takes a day to incorporate a company. For the ongoing requirements, businesses only have to do annual filings.

The process is quick and does not need tons of documents. Other reasons include audit exemption for small companies and small groups. Also, it does not set authorized capital requirements. In short, you are free to issue and own shares with minimal intervention.

Its stable financial system is a primary reason to incorporate in Singapore. During the Asian Financial Crisis, it remained unfazed. Despite having high reliance on investments, it had a swift recovery. Thanks to its various economic advantages, such as high net export and savings rate. Also, it had made no direct attempt to intervene in the capital market. It allowed a 20% currency devaluation to cushion the impact, further strengthening trade. After the crisis, it started to overtake Hong Kong.

Singapore did not avert the adverse effects during the Global Financial Crisis because it relied on American consumption. From $40,007, its GDP per capita fell to $38,926. Despite this, it bounced back, driven by fiscal stimulus. Its GDP per capita rose to $47,297 in 2010 and broke $60,000 in 2017-2019.

Singapore was not an exemption from financial crises. But what separates it from many members of the ASEAN region is its stable financial system. Its prudent macroeconomic policies enabled it to withstand challenges. If you compare their recovery from the financial crises, Singapore outdid everyone.

For instance, Singapore has more active exchange rate management. Since the 1980s, it has been applying a fixed-but-adjustable exchange rate regime with a combination of fixed and floating exchange rates. Also, it has an occasional profound devaluation to manage it better. It proved to be effective when it escaped the adverse effects of the Asian Financial Crisis. It even outdid Hong Kong, Japan, and South Korea.

Moreso, its financial sector remains robust. Thanks to its economic reforms that benefited the banking and investment industry. For instance, the local banks have a large share of domestic banking assets. They are profitable, liquid, provisioned for non-performing asset exposure, and well-capitalized. Another initiative that stabilized its growth was the overnight facility. It has helped reduce short-term interbank rate volatility.

Now, it has a new initiative that fits the current macroeconomic changes. It has $5.11 billion in funds to enhance liquidity and support banks amidst the pandemic. It enabled banks to cover customer and business needs through lending and support. It paid off in only a half year with a 6% growth in the financial sector. Now, it has already outpaced its pre-pandemic growth. Once the economy reopens fully, it will have better growth prospects.

But a more significant milestone is the increased number of cashless transactions. Given the situation today, people tend to avoid physical and cash transactions. Digital wallets, corporate cards, and virtual cards are more common now. Cryptocurrencies are spurring growth as more businesses adapt to this popular trend, leading to convenient and seamless transactions, increasing efficiency and growth potential.

The Singapore government supports businesses through pro-growth and innovation policies such as grants, tax exemptions, and in-kind help. These programs stir growth to small-to-medium enterprises (SMEs) through various financial assistance programs, subsidies and tax incentives to companies within the preferred sectors.

Moreover, companies do not have to worry about corruption. It gives generous compensations but imposes harsh punishments on corrupt officials. It also provides intellectual property protections to avoid the appropriation of wealth. In turn, Singapore is now one of the least corrupt countries in the world.

Foreign companies can own 100% of Singapore incorporated company stocks in Singapore. As such, owners can put up a company with their preferred capital structure. They can bring capital from other countries to invest in Singapore businesses. Lastly, there is a free movement of foreign currencies in and out of the country.

Image Source: Pexels

Image Source: Pexels

Singapore offers a conducive environment for domestic and foreign companies. As such, company registrations and capital inflows have increased over the years. Entrepreneurs always receive support and protection from the government, whether a sole proprietorship, Limited Liability Partnerships (LLPs) or Limited Liability Companies (LLCs). Before you find out how to incorporate in Singapore, you must choose your preferred type of business entity. Here are the types of business entities in Singapore.

Like a typical Limited Liability Company, an LLC in Singapore offers liability protection. These are separate legal entities from the owners. Given this, only the company can sue, be sued, acquire assets, or enter into contracts. An LLC can be a private limited company (Pte Ltd) or an exempt private company.

Payables and loans only extend to the company, not the owners’ assets. In short, founders can only pay up the liability to the capital put into the business. Moreso, ownership depends on shareholdings or the number of shares.

A Limited Liability Partnership in Singapore appears to be a fusion of an LLC and a partnership. Its operations and structure are the same as a typical partnership. But, the owners have a separate legal identity. As such, liabilities extend only to the company. It has perpetual succession, so changes in partners will not affect its existence. Click this link for further details.

A Sole Proprietorship in Singapore is the simplest type of business structure. Only one person or a company registered in Singapore owns them. The owner does not have a separate legal entity from the business in this structure. Hence, liabilities may extend to the owner’s assets. Also, taxes are filed in the owner’s income tax returns.

| Benefits of Incorporating a Limited Liability Company | ||

| Tax Benefits | Companies enjoy a tax break for the first three years since incorporation. Corporate taxes are capped at 17%, 8.5% for the first SGD 300,000 income and 0% for income below SGD 100,000. | |

| Professional Image | Owning a company can enhance your professional image. It will help you create a strong base for investment and growth. | |

| Perpetual Existence | Owners can be replaced without affecting the existence of the company. | |

In the business world, almost everything happens in the wink of an eye. As such, it is a must that you must put your ideas into action. Keep in mind that it is a fast-paced environment, so you must move fast. Here are some reasons why you must incorporate early in Singapore.

Early incorporation helps you secure a company name. Once incorporated, you can register it as a trademark to protect it.

It enables you to secure a larger stake before the new business creates value.

Finding resources can be challenging for startups. With early incorporation, you are ahead of your potential competitors. More so, you can prepare early to secure funds. Once you establish your business, you can entice investors to fund your expansion. Banks will extend credit for your financial leverage.

You have to incorporate early, especially when you enter into lease agreements.

With early incorporation, you can protect your intellectual property. In that way, you can avoid disputes with your competitors and employees.

Everything is better With Spenmo. When establishing your business, your day-to-day transactions are your primary concern. In a fast-paced environment amidst the CoViD-19 pandemic, safety and convenience are your priority. So, virtual credit cards and corporate cards guarantee efficiency and security.

For more details, reach out and seek assistance from Spenmo today. The company provides optimal products and solutions in the fintech industry. Hence, it assures you of its quality whenever you need it, wherever you are.

The rule of thumb for this is you do it when your business is earning beyond your lifestyle. For many, incorporation is a wise move for a company earning over $100,000.

It takes two days at most to incorporate in Singapore. Business owners can submit their applications online at the Accounting and Corporate Regulatory Authority (ACRA website.

Incorporation in Singapore costs $315, including the name application fee and registration fee.

As Singapore emerges from the virus strong, what strategies will business owners take to implement an efficient remote working scheme?

Singapore is the world’s top jurisdiction to start a new business. Choose from these 7 business ideas to help you earn profits within the city state.

Knowing how online advertising in Singapore works is helpful to business growth. Spenmo provides virtual cards to help you manage your marketing...

Sign up to get the latest news, updates, and special offers delivered directly to your mailbox