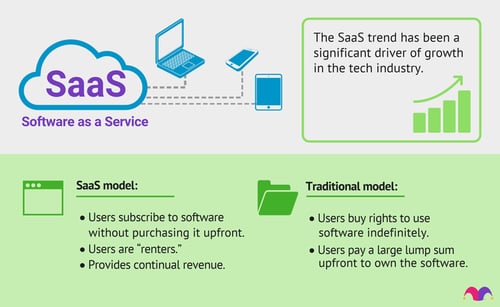

The beauty of SaaS in unpredictable times like these is the flexibility that it provides, like a switch of “on” and “off” the service/software subscription when you deem it no longer relevant for your business. You do away pumping large amounts of money into on-premise infrastructure that may be outdated in a couple of years with either security guidelines or technological tools that is ever so fast-changing.

2.Synergising tech adoption & communication

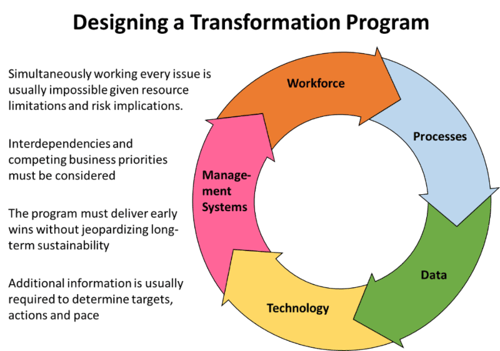

Accountants and other finance professionals cannot afford to work in silos anymore, and tech adoption has to be on pace across departments to sync up and maximise its cost- and time-efficiency benefits. Some have suggested picking a representative from each team to be part of an innovation committee. Its objective is to identify pain points of synchronising communication from one team to another and brainstorm digital solutions that can be tapped to ensure the smooth integration of data across all aspects of the company.

There are also opportunities for greater synergy of tech adoption and communication between companies (company-customer, company-supplier) and between countries and regions. Tech is increasingly less expensive to implement as it becomes more widespread and more accessible for both MNCs and SMEs-alike.

Partnerships also come in the form of accelerator programs to build on the expertise of startups, as well as M&As. Lastly, technological innovation often outpaces the adaptive ability of the people and the organisation at large. That being said, training, say tech talks related to the deployment of different kinds of technologies, will be a necessary aspect to complement the acceleration of technological investments and adoption within the company. In the regard of management, business strategies are to be continually reviewed, say by a designated innovation committee made up of representatives from different departments, given how fast-changing the industry landscape is. Aside from competitors, remember that your customers are also under the same kind of pressure to make better use of tech and data. There is also continued pressure to hone your product and service offerings to make them relevant for your target market.

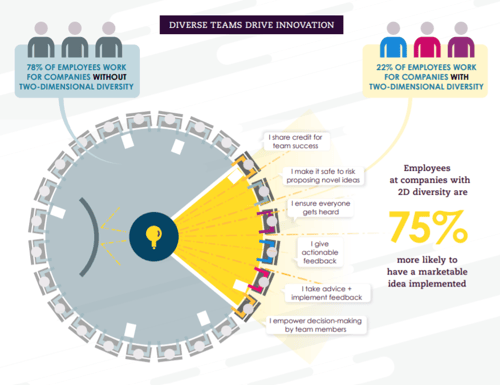

When it comes to risk analysis and decision-making, teams with (1) members of diverse profiles coupled with (2) space aka “airtime” that is provided, can improve innovation. The essence of innovation is in the ability to see things differently. Unique viewpoints are gathered through the intentional recruitment and inclusion of employees coming from different mixes of gender, ethnicity, background, history, and approach among other factors.

An endnote on diversity and inclusion: We want to share a quote by the CEO of General Motors on the intentional inclusion of diverse viewpoints:- “If we are all in agreement on the decision – then I propose we postpone further discussion of this matter until our next meeting to give ourselves time to develop disagreement and perhaps gain some understanding of what the decision is all about.” – Alfred P. Sloane, CEO of General Motors.

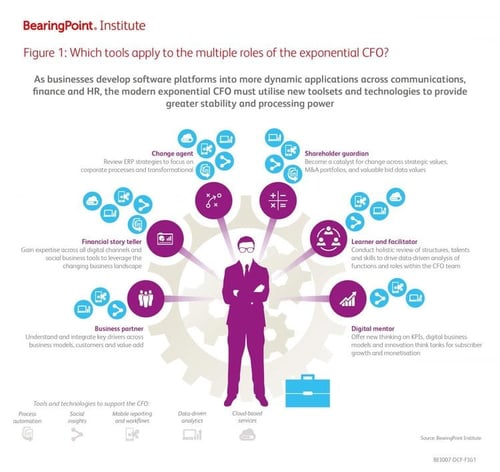

Rise of the strategic-minded CFO

We have emphasized before in our previous post that an outlook of the accountant of the future will go beyond chomping down numbers to being more conscientious of making decisions incorporating matters of fact (which a robot can probably do better) and social-cultural factors (which a human does better at laying these into consideration). The illustration below sums up the roles of a strategic-minded CFO:

Source:

Source:

Source:

Source:  Source:

Source: