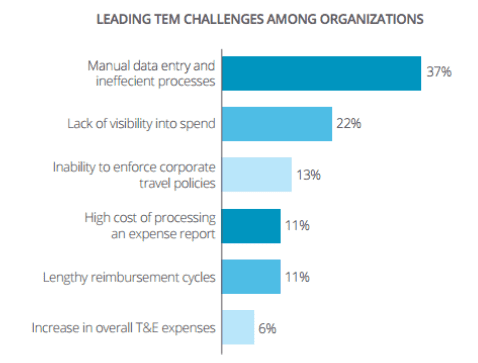

Consider this along with a business resource that’s used up to manage the volume of expenses that your growing business is incurring every month (categorizing them, archiving the documents and manual data-entry…), it’s of utmost importance for us to detail a short and snappy guide to automate your expense management and considerations should you want to make the switch from spreadsheet to the Cloud.

What is expense management?

Expense management is a system that businesses of all sizes use to record employee expenses, execute payments, and track expenses. This includes internal procedures, policies, and expense reporting which determine how the business will reimburse its employees for the costs incurred. Examples of employee-initiated expenses include, but are not limited to, travel and entertainment expenses.

What’s the difference between an Accounts Payable and an Expense?

Find out more here >>>

Why do businesses need an expense management system?

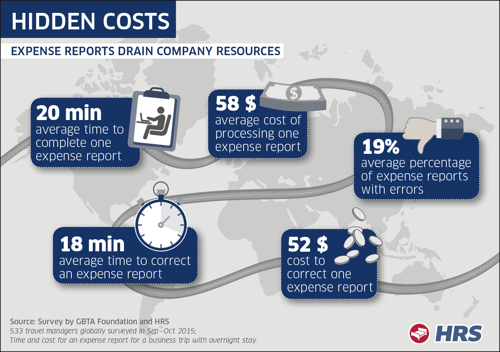

The most obvious reason being the cost and employee time savings in place of processing a claim for an expense. According to the Aberdeen Group (as cited in The Abacas Blog), the average cost of processing a single expense report is $20.65 factoring in the time it takes for a finance team to review, approve, file and reimburse expenses.

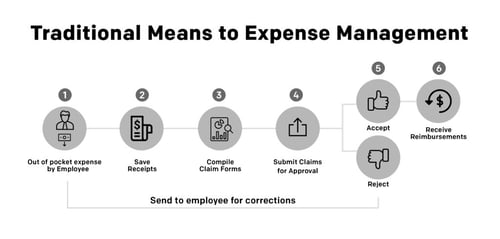

Instead of having your team member spend half of the day completing a claims form, sorting out receipts and then compiling it in an email to get your expense approval (and more to-and-fro emails for approval process and reimbursement with yourself and the finance team), their productivity could be applied on the product instead.

Smaller businesses and start-ups are increasingly globalized today. That said, travel expenses are inescapable for the business. Along with it comes extra costs such as accommodation, transportation, meals, etc. that are usually borne by the employer.

Navigating currency conversion rates is frustrating enough. Top it with the manual claiming process and converting back the currency, it’ll sure send your employee through the roof! Having an effective employee reimbursement process would greatly make your team’s life easier.

While the risk of fraud pertains to both big and small businesses, the impact is especially acute for smaller businesses given that the latter often have fewer controls and have less resources to withstand the shock. That said, an effective expense management system should enable you to gain control and real-time visibility over your records.

By connecting your system directly with other financial or accounting software like Xero or Quickbooks to facilitate a seamless transfer of data, you reduce human error; thereby ensuring the accuracy of the data. If it’s possible, tools can be instituted in the system to flag certain expense inputs as rule or policy violations.

Read more: Find out how you can reduce your business taxes by

creating an expense report

How to choose the right expense management system?

Trustradius has highlighted some characteristics of expense management systems today: That expense management capabilities can often be found within accounting systems or as standalone tools; and aforementioned features tend to be bundled with tools for procurement, invoicing, budgeting, and other financial processes.

The three main users of the system being:

- Employees who submit their own expenses or project hours;

- Managers who review, approve, and report on employees’ expenses; and

- Accounting teams who balance the general ledger or close the business’s books.

That said, some of the factors that you can take into consideration when choosing the right expense management are:

- An all-in-one system incorporating a user-friendly platform for non-accounting employees to easily file their claims, and precise tools to meet the company’s bookkeeping needs.

- Relooking at the internal expense policies and procedures. Some questions to go back to include, but are not limited to:

- Who verifies or approves the expenses?

- What types of expenses can be reimbursed?

- Are there ceilings on purchases? How much?

- How long should expense management take on average?

The context where the system is used can help you to find the solution that fits your unique business needs.

- Setting down clear requirements and expectations of what you want the system to do for your business. This will help to check the boxes and narrow down on the array of solutions out there.

Some features you may want to look at for an effective expense management system are:

- Expense Tracking: Download reports within minutes.

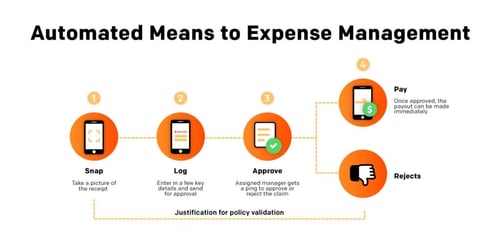

- Easy consolidation of receipts: Use your smartphone to capture and send receipts.

- Can be integrated with corporate credit cards: Assign physical and virtual cards to your employees with pre-approved funds to track spending in real-time.

- Easily route receipts or tag approvers: Forget messy emails to get approval for payments. Get internal submissions, approvals and scheduled payouts all done on 1 platform.

- Easily check for errors or violations: All transactions and its respective statuses can be accessed on the dashboard.

- Recognize limits: Preassign budgets to monitor your online subscriptions or marketing spends.

Advantages of using a SaaS-based expense management software

Businesses spend a great deal of time and resources in traditional spend management systems. That said, time and cost savings remain the main reason why enterprises may move from on-premise to cloud-based services given its low commitment, competitive pricing, ease of onboarding, and power-packed value offered through customisation based on your unique business needs.

Monetary losses may be incurred from the erroneous processing of invoices. The manual reporting process of handling a high volume of paper receipts coming from different sources is no easy feat for the finance team either.

However, when expense management is automated, the software can be programmed in a way that detects missing or duplicate invoices and raises a real-time notification. That said, you reduce the risk and errors in the aspect of invoice management and ensure greater transparency in the system.

Especially for small businesses and start-ups, collaboration is at the heart of their working culture and the Cloud framework of SaaS-based expense management systems like Spenmo facilitates collaboration that streamlines workflows across different locations.

As long as you have an internet connection and a device that has access to the expense management mobile app or web platform, you can file a claim, approve an invoice, access your reports all on the go through the platform even out of the office. You recalled that you made an error? Easily access the platform for integration, correction, submission and review of your claims.

Automation of your expense management system can future-proof your business finances. You want to easily check real-time and anywhere what exactly your business has been spending on and decide whether these expenses can be trimmed to maximize your profits. The benefits that businesses reap from leveraging technology and SaaS are endless.

Check out our article on Accrued Expenses and their impact on your financial reporting